By Rinki Pandey July 12, 2025

Farmers markets are a growing force in U.S. local commerce, expanding by around 7% each year. To capitalize on this growth, today’s market vendors need more than a cash box – they need a modern Point-of-Sale (POS) system. A well-chosen POS can streamline operations, track sales and inventory, and accept the wide array of payments customers expect, from credit cards to contactless taps. But not every retail POS fits the unique demands of an outdoor farmers market.

This guide will walk through essential features to look for in a farmers market POS system, explain why they matter (especially for U.S.-based markets), and provide examples like Square, Clover, and Shopify POS to illustrate how different solutions stack up for both small vendors and larger market sellers.

Unique Challenges of Farmers Market Sales

Selling at a farmers market isn’t the same as running a typical brick-and-mortar store. Outdoor and mobile selling comes with special considerations that your POS system must handle. For example, farmers market vendors often face:

- Unreliable Internet and Power: Market stalls may have spotty Wi-Fi/cellular connectivity or even no readily available power outlets. This can cripple a POS that requires constant internet.

- Varied Inventory Sold by Weight: Many products (produce, bulk goods) are sold by weight or in variable sizes. Your POS may need to integrate with a scale to calculate prices on the fly. Not all systems handle decimal weights or per-pound pricing well.

- All-Weather, Outdoor Conditions: Heat, cold, rain, or bright sun – an outdoor environment can be harsh on electronics. POS hardware might need to be more rugged or have accessories like cases and sunshades. A device that overheats or a paper receipt printer that fails in humidity can slow you down.

- Unique and Seasonal Products: Farmers markets feature local and seasonal goods. You might sell handcrafted items or produce without UPC barcodes, requiring custom PLUs or barcode labels. Seasonality also means your sales data swings throughout the year, so tracking by season is useful.

- Limited Staff and High Traffic: Some vendors work alone, while others have helpers during peak times. Either way, markets can get busy and you’ll need to serve customers quickly to prevent long lines. An intuitive, fast POS interface is critical when juggling multiple shoppers.

- SNAP/EBT Payments: U.S. farmers markets increasingly accept SNAP benefits (via EBT cards) so low-income customers can buy fresh food. Not all POS systems support EBT out of the box (for instance, Square’s processing cannot handle EBT transactions). Vendors who want to accept EBT may need specific equipment or apps, which we’ll discuss later.

In short, the farmers market environment demands a mobile, resilient, and flexible POS. Keeping these challenges in mind will help identify the features that matter most.

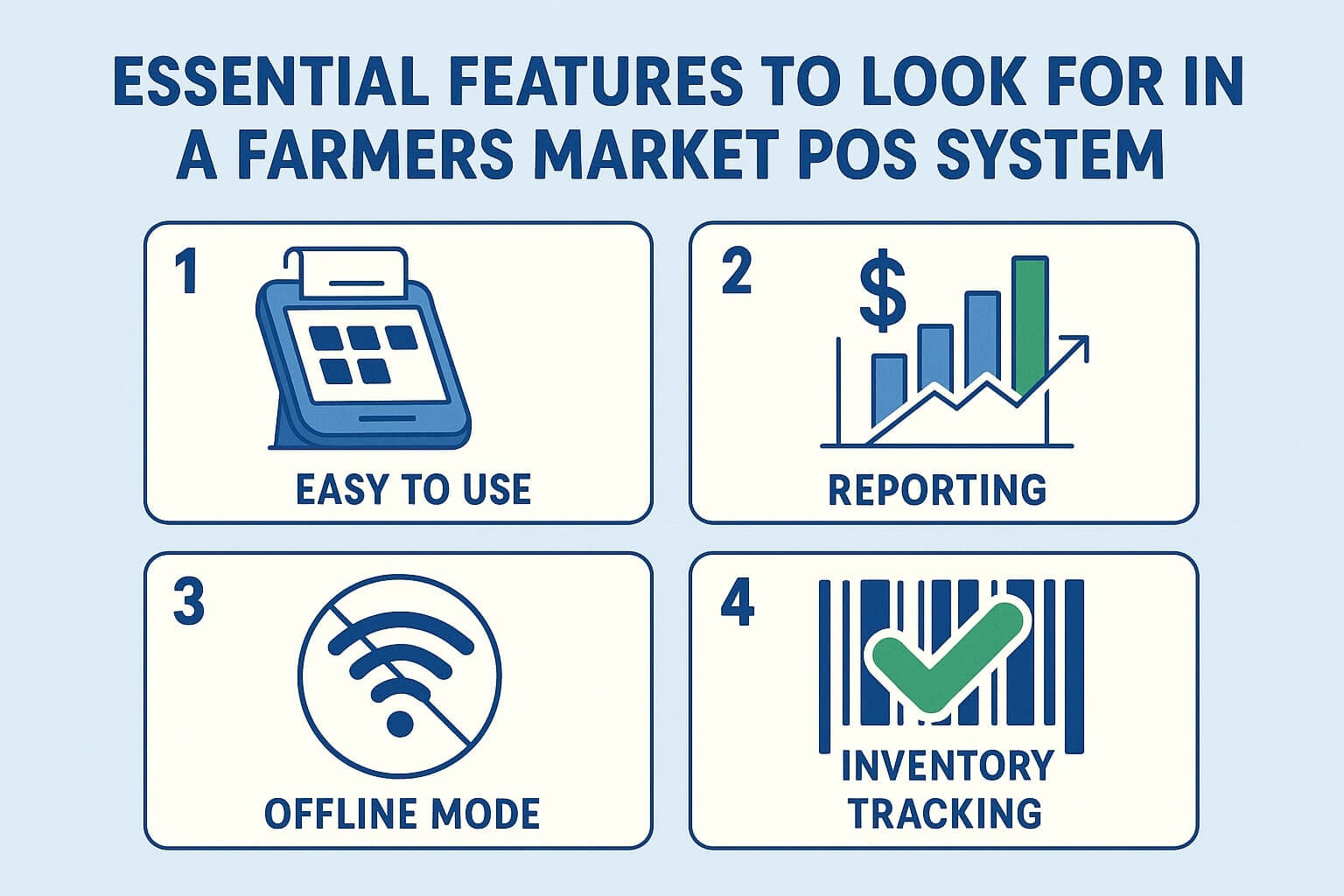

Checklist: Essential POS Features for Farmers Market Vendors

Considering the above, here is an informative checklist of key POS features to look for. These features are especially important for outdoor market selling, and we’ll note how they benefit both small solo vendors and larger market operations:

- Offline Processing Capability: Perhaps the number one requirement. An offline mode lets you record sales and even take card payments when you have no internet signal, then sync or process them later. This is a lifesaver for markets in parking lots or rural areas. For a small vendor with just a phone, offline mode prevents lost sales on sketchy Wi-Fi. Larger vendors with high volume also avoid downtime – their POS should queue transactions through lunch rush even if the network drops.

Always confirm how a system’s offline mode works and how long it can run without connection (e.g. some systems can buffer card transactions for a day or more). Example: Square’s POS offers an offline mode so you can continue swiping cards when the internet is down, whereas Shopify POS allows recording cash sales offline but cannot process credit cards until back online. Knowing these details upfront will set your mind at ease about rainstorms or dead zones not stopping your sales. - Robust Inventory Tracking and Management: Even farms selling produce can benefit from basic inventory tracking. A good POS lets you enter your products (with variants or units), update stock counts, and see in real time what’s selling out. This helps small vendors avoid guesswork – for example, a beekeeper can see how many jars of honey remain by midday.

Larger vendors or multi-market farms get even more value from inventory features: tracking dozens of products across locations, receiving low-stock alerts, and managing reorders. Look for inventory functions that handle variable-weight items (e.g. subtracting by pounds) and that can differentiate between locations if you sell in multiple markets or farm stands.

Integration with your e-commerce or farm stand inventory is a bonus, ensuring online sales and market sales don’t double-sell the same product. While not every farmer needs advanced inventory management, it’s a key benefit of modern POS to at least monitor top sellers and prevent running out of popular items. - Fast and Easy Checkout Interface: Farmers market transactions need to be quick and hassle-free – customers might be holding melting ice cream or wrangling kids, and they expect a speedy purchase. Prioritize a POS with an intuitive, minimal-step checkout process. Features like customizable hotkeys or buttons for popular items can accelerate sales (e.g. one-tap to ring up “Dozen Eggs” or a common $5 bundle).

Small vendors will appreciate saving time with each sale, especially if working alone – less fumbling with tech means more focus on customers. Larger booths with employees benefit from an interface that new staff can learn in minutes. For instance, Square’s tablet app is known for its simple, friendly design that quickly trains employees on the checkout flow. The POS should also handle voids or changes easily; if a customer swaps one item for another, it shouldn’t require canceling the entire sale. In short, look for a POS that is user-friendly, with a short learning curve and rapid item entry, to keep those market lines moving. - Flexible Receipt Options: In the informal setting of a farmers market, printed receipts might not always be needed, but your POS should offer options. The best systems let you text or email receipts to customers on the spot, which is convenient and saves paper. For bigger purchases or by request, the ability to print a paper receipt via a small portable printer can be useful. Small vendors often opt to go paperless – digital receipts also double as a way to collect customer emails for marketing later.

Larger sellers might have a mobile printer at their booth for customers who need an itemized receipt (especially if selling higher-value goods like bulk meat or crafts). Ensure the POS supports your choice: most mobile POS apps (Square, Clover, Shopify, etc.) will send digital receipts and also work with Bluetooth or USB receipt printers. Additionally, some systems let you customize receipt templates with your farm name or logo, adding a professional touch that can reinforce your brand. - EBT/SNAP Support: If you plan to accept SNAP benefits (via EBT card) – a common scenario in U.S. markets – verify what’s required to handle those transactions. Many all-purpose POS systems do not natively process EBT. For example, the popular Square card reader cannot accept EBT payments on its platform. However, there are solutions: some POS providers integrate with third-party services or offer separate PIN pads for EBT.

Clover, for instance, has an app that enables EBT transactions on certain Clover devices, and Clover’s mobile unit advertises that it even supports SNAP payments on the go. Another option is using a dedicated EBT terminal or app like TotilPay alongside your main POS. Small vendors should weigh the cost and complexity – if EBT redemptions are important for your product (e.g. fruits/vegetables), you might get state programs or grants for free EBT equipment.

Larger market sellers or markets that centralize EBT might use a single station to swipe cards for tokens/scrip. In any case, ensure you have a plan for SNAP if you want to serve those customers. The ideal farmers market POS will either handle EBT directly or easily coexist with an EBT device, and will allow tagging EBT-eligible items so that reports can separate those sales. - Multiple Payment Methods (Beyond Cash): Today’s shoppers expect to pay how they want. Your POS system should accept all major payment types: credit and debit cards (magstripe and chip), contactless payments (NFC tap like Apple Pay or Google Pay), and ideally newer options like mobile wallets or even peer-to-peer apps. At minimum, ensure the POS supports chip cards and contactless, as many customers now tap or use digital wallets.

Small vendors often start with a simple card reader – e.g. Square provides a free basic reader for magstripe and offers affordable Bluetooth chip readers. This low-cost setup enables even a one-person farm stand to take Visa, Mastercard, Amex, Discover, etc. Larger vendors might invest in a more robust terminal that can handle swipe, chip, and tap in one device (for example, Clover Flex or Shopify’s Tap & Chip reader).

Also consider if the POS can record alternative payments like checks or gift certificates, if you accept those, so all sales are tracked in one place. The goal is never to turn a customer away – whether they want to pay with a phone, a card, or EBT, your POS solution should have you covered. - Integration with Scales for Weighing Products: If you sell produce, meat, cheese, or any bulk goods by weight, scale integration is a game-changer. Instead of manually entering weights and calculating prices, a POS that hooks up to a digital scale can automatically capture the weight and compute the total cost.

This speeds up checkout and reduces errors. Some systems (e.g. Clover with the Weigh & Pay PRO app, or certain iPad POS with supported scales) offer this feature. Small farms might initially get by with a non-integrated scale (weighing items and punching price per pound into the POS), but as volume grows this gets tedious. Larger vendors definitely benefit from integrated scales – it streamlines selling produce in peak season and ensures accurate pricing.

Keep in mind that integrated POS scales can be an added cost (often a few hundred dollars), and not all mobile systems support them. If scale selling is core to your business, narrow your POS search to those that explicitly list scale compatibility or consider specialty solutions built for grocery and market use. - Portability, Battery Life, and Durable Hardware: Because you’ll be operating in a booth or tent, often without constant power, your POS hardware needs to go the distance. Look for devices that are truly mobile and battery-powered. For example, Clover’s mobile unit boasts a battery that lasts an entire market day on one charge. Even a tablet-based POS should be able to run on battery for several hours – you might invest in an external battery pack for backup.

Small vendors typically use a smartphone or tablet they already own, plus a card reader – ensure your phone is protected (a sturdy case, maybe a strap or stand) and consider a sunshade for screen visibility in bright sun. Larger vendors might use a tablet with a stand, a wireless receipt printer, and a card terminal; in this case, check that these can connect via Bluetooth or wireless, and plan for weather-proofing (e.g. keep electronics under cover from rain).

Ruggedized hardware or simple precautions like a waterproof tablet sleeve can save your day. Some POS providers offer purpose-built hardware for mobile selling (e.g. PayPal Zettle’s all-in-one device or Clover Flex) that are designed to be hand-held in markets. The key is to have a setup that is lightweight, cable-free, and can operate all day outdoors, so you can pop up at any market and start selling without needing more than maybe a tent and a table. - QuickBooks, Accounting, or E-Commerce Integration: A farmers market may be a pop-up environment, but it’s still a real business. If you use accounting software like QuickBooks or if you sell through an online store as well, your POS should ideally connect to those systems. Small vendors who are just starting might not worry about this immediately, but it becomes important as you grow (it can save hours of manual data entry).

Many cloud-based POS systems can export sales data for accounting, or even sync directly to QuickBooks Online. If you use Shopify for an online store, the Shopify POS will automatically sync in-person and online sales/inventory in one dashboard – a great benefit if you juggle multiple sales channels. Larger market sellers or co-op farms definitely appreciate centralized data: integration with accounting means daily sales totals flow into your books, and inventory integration means that what you sell at the farmers market can decrement your central inventory count.

Also look for the ability to import product catalogs or update inventory from a spreadsheet – that can be useful when you have seasonal product turnovers. In short, keeping all your data connected is key for efficiency, so think about what other tools you use (or plan to use) and ensure your POS can hook into those ecosystems via built-in features or third-party apps. - Sales Reporting and Analytics: Even for a part-time farm stand, knowledge is power. A quality POS will provide reporting features to analyze your sales – by product, category, payment type, time of day, etc. This is especially handy in farmers markets where sales can be highly seasonal. For example, you might use reports to compare your summer vegetable sales vs. fall harvest sales.

Larger vendors who attend multiple markets can track which location is most profitable or which days are slow, helping plan staffing and stock. Look for customizable or at least filters in the reports (e.g. view only Saturday market data, or only produce vs. baked goods). Some systems even allow tagging products as eligible for certain programs (like which items were EBT purchases) and then reporting on that.

Small vendors benefit too – a simple end-of-day total and a breakdown of what sold can guide what to bring next week. If you can find a POS that tracks per-item sales easily, you’ll know your best-sellers (e.g. “50 lbs of tomatoes sold vs 5 lbs of zucchini – plant more tomatoes next season!”). For seasonal businesses, ensure the POS can generate reports across custom date ranges (month-to-month, year-over-year comparisons). The bottom line: choose a POS that gives you insight into your business, not just raw transaction logs. The ability to analyze seasonal trends and product performance is a big plus for market sellers. - Multi-User and Multi-Location Support: This feature grows in importance as your business grows. Single vendors might not need separate user logins, but if you have employees or family helping run the stall, having individual staff PINs or accounts on the POS can help track who sold what (and enable permissions if you don’t want staff issuing refunds, for example). It can also double as a time-clock in some systems.

Larger market sellers or those with multiple booths/farm stand locations should check that a POS allows adding multiple devices and locations under one account. Square, for instance, lets you add extra devices or locations easily as your business expands. This way all your sales roll up into one dashboard, but you can view them by location or by staff. If you participate in two farmers markets on the same day, you might run two iPads with the same POS account – make sure your system can handle that without confusion.

Also, if you have a storefront or do events in addition to the farmers market, consider a POS that supports multi-channel selling seamlessly (for example, inventory and sales tracking across your farm store, your farmers market stall, and maybe an online shop). - Reasonable Costs and Transaction Fees: Cost is always a factor, especially for small farms on tight margins. When evaluating POS options, consider software subscription fees, credit card processing fees, and hardware costs. Many mobile POS systems like Square and PayPal Zettle have no monthly fee, instead charging a flat transaction rate (e.g. ~2.6% + 10¢ per swipe). This model is great for small vendors because you pay only when you make a sale, and the percentage fee is manageable at low volume.

However, if you become a high-volume seller, those percentages add up – larger businesses might save money with a POS that has a monthly plan but lower processing rates. For instance, Shopify POS or others might charge ~$60/month for advanced features but then slightly reduce the per-swipe rate.

Traditional merchant accounts (like those used with Clover or standalone terminals) often have lower percentage fees for credit cards but may involve monthly charges. It’s important to estimate your sales volume and do the math. Also, watch out for extra fees: some providers charge for things like phone support, PCI compliance, or add-on software modules – whereas others, like Square, pride themselves on no hidden fees beyond the transaction rate.

Now that we’ve covered the must-have features in checklist form, let’s look at how a few popular POS platforms incorporate these features, and which might be suitable for different types of farmers market sellers.

Comparing Popular POS Systems for Farmers Markets

There are dozens of POS solutions out there, but a few names frequently come up for small businesses and market vendors. Here we’ll compare Square, Clover, and Shopify POS – highlighting how each addresses the key features and the needs of small vs. larger sellers. We’ll also mention others where relevant.

Square POS (Square Point of Sale)

Square is often synonymous with mobile payments – many farmers market vendors start with Square because of its simplicity and low barrier to entry. Square’s POS app is free to use (no monthly fee), and you can get a basic card reader dongle for free to swipe cards on your phone. This makes it extremely attractive to small vendors or first-timers. Some key points about Square for farmers markets:

- Offline Mode: Square supports offline credit card processing – if you enable offline mode, you can swipe chip or tap payments without connectivity (up to a certain amount), and the app will process them when you’re back online. This gives peace of mind in unreliable network conditions. (Note: offline transactions carry a risk if the card is declined later, but it’s a handy feature when needed.)

- Inventory & Items: Square allows you to set up a product library with prices, categories, and even photos. It’s easy to ring up items or adjust quantities. While some small produce sellers might not itemize every vegetable, those who do (e.g. selling packaged goods or crafts) will find Square’s inventory sufficient. It even has an “Units” feature to sell by weight or volume, though without a direct scale integration unless using Square for Retail on iPad. Square also supports barcode scanning if you use barcodes.

- Speed/Ease of Use: One of Square’s biggest pros is its intuitive interface. It’s consistently rated highly for ease of use. Training a helper to use it is quick – the buttons are clearly laid out. You can save favorites or use a numeric keypad for custom amounts (useful if pricing produce by the bunch). Square also recently introduced Tap to Pay on iPhone for vendors, meaning certain iPhones can accept contactless payments without any reader device at all – ideal for quick sales with minimal hardware.

- Payments Accepted: Square accepts all major credit and debit cards, and its reader can take chip and contactless payments (Apple Pay, Google Pay, etc.). However, Square does not support EBT/SNAP card processing. A vendor who needs to accept EBT would have to run a separate EBT terminal or use a different provider for those transactions. Square does let you record other tender types (like checks or gift cards) for tracking purposes, but it won’t process EBT funds.

- Receipts & Extras: With Square, you can offer digital receipts (text or email) easily, or connect a portable printer if needed. You can also set up tipping screens, apply discounts, and even run loyalty programs or gift cards if you choose to add those features. For farmers markets, the ability to quickly apply a discount (e.g. “market special $1 off”) or collect tips (say for a farmstand café) can be useful, and Square handles those well.

- Multi-User/Multi-Location: Square allows adding multiple staff logins and additional devices on your account for free. For example, if a farm has two people each with a phone taking sales under the same Square account, it will consolidate the data. You can also set up separate locations (e.g. “Saturday Market” and “Farm Store”) under one Square account if needed. This flexibility is great for a growing business – you won’t pay per device or user unless you opt for advanced employee management features.

- Costs: The basic Square Point of Sale app is free. Processing fees are the main cost – currently around 2.6% + 10¢ per in-person transaction in the standard plan. There are no monthly fees unless you upgrade to add-ons (like Square for Retail Plus, which is $60/month and offers more advanced inventory tools, or Square Loyalty, etc.).

Hardware beyond the free magstripe reader is reasonably priced (the Square contactless+chip reader is about $49, and the all-in-one Square Terminal that prints receipts is about $299). For most small to mid-size vendors, Square’s costs are predictable and competitive. Larger vendors doing very high volume might find those percentage fees less economical over time and could negotiate rates or consider other systems, but many mid-sized farms still stick with Square for its convenience.

Clover POS (Clover Mobile/Flex/Station)

Clover is a popular POS platform known for its sleek hardware and app-based flexibility. Unlike Square, Clover is often obtained through banks or payment processors (since Clover hardware is proprietary). Clover offers a range of devices – Station (full countertop register), Mini, and mobile options like Clover Flex or the older Clover Mobile – which are well-suited for on-the-go use. For farmers markets, the Clover Flex (a handheld device with built-in receipt printer) or a Clover Mini with a wireless setup are common choices. Here’s how Clover stacks up:

- Mobile and Offline Use: Clover devices are designed to work both in-store and on the move. The Clover Flex, for example, has a touchscreen and battery to run all day, so you can carry it around the market. Clover does have an offline mode setting (according to Clover’s help, when enabled it can take payments offline for up to 7 days) – meaning you can accept card swipes if the network is down, and they’ll authorize later. This is critical for outdoor selling, and Clover’s offline capability is fairly robust. Just as with other POS, you’ll want to reconnect ASAP to finalize those payments.

- Payments and EBT: Clover shines in accepting a wide variety of payment methods. It supports credit, debit (including PIN debit), chip cards, contactless payments, and yes, EBT SNAP in certain configurations. Specifically, Clover’s system can process EBT if you use an app from their marketplace (and your merchant account is set up for EBT).

Not every Clover bundle includes that by default (and note that Clover Go – the phone-connected dongle – does not do EBT, but the standalone devices can). For a vendor who wants an all-in-one device to take SNAP cards directly at the stand, Clover is one of the few mainstream POS options that can do that. This could make a big difference for markets where individual vendors handle their own EBT transactions. - Feature Flexibility via Apps: One of Clover’s unique advantages is its App Market – an ecosystem of apps that add functionality to the POS. For farmers markets, this means you can tailor the system to your needs. For example, Clover has apps like DAVO for automated sales tax filing, StockIt for inventory management, and Weigh & Pay for integrated scale selling by weight. If you need a loyalty program, customer CRM, or even online order integrations, chances are there’s a Clover app for it.

This modularity is great for larger vendors or those with complex needs – you’re not stuck with one-size-fits-all; you can pick and choose apps (some free, some paid) to enhance the system. Small vendors might not immediately use many add-ons, but it’s nice to know the system can expand (for instance, adding a QuickBooks integration or a time-clock app if you hire staff later). - Inventory and Interface: Out of the box, Clover allows product management (items with price, stock count, modifiers, etc.). It’s quite capable for tracking inventory, though the interface on the smaller device screens can be a bit crowded compared to a tablet. Many farm vendors using Clover simply set up quick-sale buttons (or even use the calculator-style “enter amount” for each sale). But if you have a consistent product list (jars of salsa, cartons of eggs, etc.), Clover can handle it, and you can import a large item catalog via their dashboard.

For ease of checkout, the Clover touchscreen interface is generally considered good (not quite as dead-simple as Square, but still intuitive). The Clover Flex device has a smaller screen, but it’s designed for easy swiping and tapping through a sale. You can also preset popular items with pictures, similar to Square’s hotkeys. Training staff on Clover is straightforward, though there’s a slight learning curve to its menus and the concept of apps. - Hardware Considerations: With Clover, you must use Clover hardware – which means an upfront cost or a monthly rental/plan. The upside is the hardware is well-integrated: for example, the Clover Flex can scan barcodes with its camera, print receipts on the spot, and has a built-in card reader. It’s a very self-contained solution (no phone or iPad needed).

Small vendors might find the initial cost higher than something like Square (which leverages your existing phone/tablet). However, some banks offer deals or rentals for Clover devices. The hardware is sturdy and meant for daily use, which is appealing to larger sellers who need reliable equipment week after week. Keep in mind that if you ever wanted to switch systems, Clover hardware generally can’t be repurposed for other POS software – so it’s a commitment. - Costs: Clover’s pricing can vary depending on the reseller or merchant service provider. Typically, you’ll have a monthly software fee (for example, a Clover Register plan) and then transaction fees. Some providers offer Clover with a flat rate similar to Square’s (around 2.6% + $0.10), others use interchange-plus pricing. The Clover Flex device might cost a few hundred dollars to buy outright or around $30-$50/month to lease, as an estimate.

There might also be fees for certain apps in the Clover App Market (some are subscription-based). Overall, for a small vendor, Clover tends to cost more per month than using a free POS like Square, but it can be worth it if features like EBT and all-in-one hardware are must-haves. Larger businesses that process a lot might negotiate better processing rates through Clover, potentially lowering costs in the long run. Be sure to compare the total cost of ownership (device + monthly + transaction fees) with your expected sales volume.

Shopify POS

Shopify POS is the point-of-sale solution offered by Shopify, a major e-commerce platform. It’s a slightly different beast because it’s designed to tie in with Shopify’s online store system. For farmers market sellers who also maintain an online Shopify store (for example, selling farm products online or offering CSA subscriptions), Shopify POS can be an attractive choice to unify online and offline sales. But even if you don’t sell online, Shopify POS (using the Shopify app on iPad or iPhone) can function as a standalone store POS. Key points for Shopify POS in a market context:

- Online-Offline Integration: The biggest selling point of Shopify POS is that your inventory, products, and customer data stay synced between your online shop and your POS. If you’re a vendor who, say, sells jams and crafts on Shopify’s website and at the market, this system ensures that when you sell an item at the market, your online inventory updates (preventing overselling). For small vendors just at the market, this may not matter; but for larger sellers or those expanding to e-commerce, it’s extremely convenient. You manage one product catalog for both channels.

- Mobile POS App: Shopify POS runs on your own device (iPad, iPhone, or Android device). They offer proprietary card readers (e.g. the Shopify Tap & Chip reader) that connect via Bluetooth to process cards. The app itself has a modern interface, somewhat comparable to Square’s. You can add products to the cart by tapping your item list, scanning barcodes (if you use them), or using a custom sale amount. It’s generally easy to use, though some advanced features (like certain analytics or custom receipts) require Shopify’s paid plans.

- Payments: With Shopify POS, if you use Shopify’s built-in payments, you can accept all major credit cards and contactless payments. The rates depend on your Shopify subscription level (Basic, Shopify, or Advanced plans have different rates, e.g. around 2.4% to 2.7% for in-person cards). It also supports other methods like gift cards (Shopify’s own gift card system) and can record cash transactions.

EBT is not supported on Shopify’s platform (similar to Square in that regard). If EBT is needed, a separate workaround would be required (like using a standalone EBT terminal). One nice feature: Shopify POS on iPhone supports Tap to Pay (like Square), meaning you can accept contactless payments directly with just an iPhone – no reader needed, which is great for quick sales or as a backup if your reader isn’t working. - Offline Capability: Earlier, Shopify POS did not allow offline card transactions (which was a pain point for many). As of 2025, Shopify introduced an offline mode for its POS, but with limitations. Essentially, you can continue to cart items and mark transactions as cash or custom payments offline, and then those will sync when online. However, you cannot process credit card payments offline with Shopify POS – the app will require internet to actually charge the card. This means if you lose connectivity, you’d have to either take cash or perhaps use a manual imprint and run the card later.

For market sellers, this is a consideration: if your market has reliable cell service, it’s fine; if not, Shopify POS might risk losing card sales during outages. (By contrast, Square and Clover can capture card swipes offline.) That said, Shopify’s offline mode will ensure your offline cash sales or orders are queued and inventory adjusted once you reconnect – so it’s better than nothing, but not as seamless for cards. - Inventory & Features: Shopify POS has good inventory management (linked with the online store inventory). You can organize products by category, use barcode labels (Shopify even sells a hardware kit with a barcode printer and scanner if you need it). For a farmer, you might not use barcodes on veggies, but if you sell packaged goods or non-perishables with SKUs, the scanning ability is helpful. The system can also handle multiple locations – you can track inventory separately for your market stock and your on-farm store, for example.

One standout feature is analytics: Shopify’s higher-tier POS plans provide in-depth sales reports, product performance, and even profit reports if you enter cost of goods. This can be beneficial for larger sellers who want to dig into data. For small vendors, the Basic Shopify plan gives you basic reports that are probably sufficient (total sales, sales by product, etc.). - Multi-Channel Customer Management: Because it ties into the Shopify ecosystem, your POS can leverage features like customer profiles and email marketing. For instance, if someone buys at your stall and you email them a receipt, they’re now in your Shopify customer list – you can see if they later buy from your website, or send them a thank-you discount via email.

This blending of offline and online customer data is powerful if you aim to build a loyal following. It’s somewhat beyond the needs of a casual market seller, but for those building a brand, it’s a perk. Shopify POS even lets you set up discount codes or promotions that work both online and at the market (e.g. a “SpringSale” code you advertise on social media can be redeemed in person through the POS). - Hardware and Setup: To use Shopify POS, you’ll need a Shopify subscription (at least the Basic $29/month plan) and the free Shopify POS app. The card reader hardware is purchased separately (around $49 for the Tap & Chip reader). If you want a full setup, Shopify offers a retail kit with a dock, receipt printer, etc., but at a farmers market you likely only need the reader and your device.

One thing to note: if you’re not already selling online with Shopify, paying $29/month just to use the POS might be pricier than other options that have no monthly fee.

However, if you do sell online, then adding the POS is effectively no extra cost (Shopify includes POS Lite with all plans). For those who need more advanced POS features (like unlimited registers and in-depth POS staff permissions), Shopify offers a POS Pro add-on at $89/month – probably overkill for most market vendors unless you run multiple retail outlets.

Other Noteworthy POS Options

While Square, Clover, and Shopify are well-known, a few other platforms deserve a mention for farmers market contexts:

- PayPal Zettle: PayPal’s Zettle (formerly PayPal Here) is a mobile POS with no monthly fee, low flat transaction rates, and an all-in-one card reader device. It’s similar to Square in many ways. Zettle handles cards and contactless payments (and even records cash sales), and offers basic inventory and analytics. It doesn’t do EBT, but it’s a solid choice for small vendors who might already use PayPal. One con is it requires connectivity (no offline mode for cards).

- Local/Food-Specific POS: Some systems like POS Nation or IT Retail cater specifically to grocery and market vendors. These often have robust scale integrations, PLU management, and even EBT support. They’re worth looking into for larger market operations or co-ops. However, they might be overkill or too expensive for a single vendor at a weekend market.

- Lightspeed (Vend) or Toast: Lightspeed’s Vend (retail-focused) POS has a strong offline mode and inventory features, but it’s geared toward multi-inventory shops and charges monthly fees (and Vend, specifically, is iPad-only). Toast is a restaurant POS – great if you’re a food truck at a market, but not needed for selling produce.

- TotilPay (Novo Dia): This is a popular mobile app specifically for processing EBT/SNAP at farmers markets. It can operate as a simple POS for EBT and credit transactions and was in fact used by many markets in partnership with programs like MarketLink. If EBT is central, a small vendor might use TotilPay for all transactions (it supports offline EBT processing with some fees). However, its feature set for inventory and advanced reporting is limited, so some use it alongside another system.

Each system has its pros and cons – the best choice depends on your specific needs and scale. Next, we’ll address a few common questions that market sellers often have about POS choices.

FAQs: Farmers Market POS Systems

Q1. Do I need internet access to use a POS at an outdoor market?

Answer: Most POS systems need an internet connection at least periodically, but many offer an offline mode to keep you going if you lose signal. In practice, if you have a strong 4G/5G cellular or a reliable Wi-Fi hotspot at your market booth, your POS will work normally. However, given the spotty connectivity at some markets, it’s wise to choose a system with offline capabilities.

For example, Square and Clover can buffer card transactions offline (processing them once you reconnect). Shopify POS allows offline recording of sales but cannot actually authorize credit cards without internet. Always check the offline limits – e.g. some systems might limit the dollar amount or number of offline card transactions for security.

And remember, even with offline mode, you’ll eventually need to get online (by end of day or within a set time) to upload those sales. If your market truly has zero connectivity, you might consider accepting mostly cash and swiping cards with a knuckle-buster for later, but that’s a rare worst-case scenario. In summary, internet is not strictly required at every moment if your POS has offline mode, but you do need some connectivity at least before or after the market to sync data and process payments.

Q2. Can a POS system handle items sold by weight or in bulk?

Answer: Yes – many modern POS systems support selling products by weight, either through built-in features or by integrating with a scale. The simplest method some vendors use is to have preset unit buttons (like “Tomatoes $3/lb” and then enter the weight manually). But a better solution is a POS that can connect to a digital scale. Systems like Clover, Square (with certain hardware), POS Nation, and others offer scale integrations where the weight reads directly into the POS.

If integrated, the POS will automatically calculate the price (e.g. 2.5 lbs at $3/lb = $7.50). If a full integration is too pricey, an alternative is using a scale that can print a barcode label with the weight/price (common in grocery). You weigh an item, the scale prints a sticker barcode, and then you scan that with your POS. This is more feasible for larger operations (like a meat vendor pre-weighing cuts).

For a small farmer selling produce, you might simply weigh on a scale and key in the price per pound into your POS on the fly – it works, but it’s prone to keying errors and a bit slower. In any case, ensure the POS can handle decimal quantities and variable pricing. Many POS have a “unit type” setting for items so you can sell by 0.01 lb increments, etc. If you foresee a lot of bulk sales, investing in a compatible scale and POS that support it will pay off in speed and accuracy.

Q3. Does a farmers market vendor really need a POS system? What are the benefits versus just using cash?

Answer: While it’s possible to run a cash-only stall with a calculator, a POS system provides significant advantages in today’s market environment. First, customers expect the convenience of card or mobile payments – you’ll simply make more sales if you’re not cash-only. Many people don’t carry enough cash at markets, and they may skip a purchase if they can’t swipe a card. So a POS expands your customer base and impulse buys. Second, a POS helps you track your sales data.

Instead of guessing how much you made or which items sold well, you’ll have records. This is useful for planning inventory, setting prices, and doing taxes. Third, features like adding sales tax where applicable, applying discounts, or even managing a simple loyalty program (e.g. “buy 10 coffees, get 1 free” via the POS) can enhance professionalism and customer loyalty. For small vendors, using an easy POS like Square doesn’t add much burden – it’s quite straightforward and you can still accept cash alongside it (the POS will just log cash sales too). For larger vendors, a POS is almost essential to coordinate multiple payment methods and staff.

Additionally, if you accept SNAP/EBT or credit, you need electronic processing – a POS or card reader is the tool for that. Lastly, a modern POS can save time on the back end: summarizing your day’s total, helping with accounting, etc., which frees you up to focus on farming or production. In short, a POS system at a farmers market makes your business more efficient, data-driven, and customer-friendly, and in an age where technology is accessible and affordable, it’s a smart upgrade from the old cash box.

Q4. How do transaction fees work and can I pass those fees to customers?

Answer: Transaction fees are charges from payment processors for each card sale – typically a percentage of the sale plus a fixed amount. For example, a common rate is ~2.6% + 10¢ per transaction (so a $10 sale costs about 36¢ in fees). Different POS providers have different fee structures: some (like Square, PayPal) have fixed rates; others (like merchant accounts for Clover) might have variable or tiered rates.

As a vendor, you generally cannot directly charge customers extra for using EBT or a credit card at farmers markets (at least for EBT, it’s prohibited by SNAP rules to add a surcharge; for credit cards, it’s against card network rules in many cases unless explicitly allowed and disclosed as a cash discount or surcharge). Some markets or vendors instead price items with the fee in mind or offer a discount for cash.

For example, you might price your goods assuming card fees and give a small “cash discount” if someone pays cash – this effectively avoids penalizing card users explicitly. There are also cash discount programs some POS offer, which automatically adjust pricing for cash vs card to cover fees in a legally compliant way. For the most part, consider transaction fees as a cost of doing business for the convenience of more sales.

By increasing your sales volume and efficiency with a POS, many vendors find the fees are outweighed by higher revenue. And remember to factor the fees into your pricing strategy across the board so your profit margins remain healthy. If you operate on very thin margins, you could set a minimum purchase amount for cards (e.g. “$5 minimum for credit cards”) to ensure small fees don’t eat a huge percentage of a $1-$2 sale – though such minimums should be clearly posted and are allowed by card rules up to $10.

Q5. Which is better for a farmers market – a simple mobile card reader (like Square) or a full POS terminal?

Answer: It depends on your business size and needs. A simple mobile setup (phone + card reader + app) is usually best for a small vendor or someone just starting out. It’s low-cost, easy to use, and very portable. Solutions like Square, Zettle, or Shopify on a phone fall into this category. You get all the essential functions: take cards, track sales, maybe basic inventory. As your business grows, you might feel the limitations – perhaps you want a faster checkout with a dedicated device, a receipt printer, or more integrations (like scales or peripherals).

That’s when a more full-featured POS terminal or tablet system makes sense. For instance, if you find yourself with a permanent market booth or a farm store, a setup with an iPad, cash drawer, receipt printer, and a sturdier card terminal might improve your workflow. Larger sellers also might need things like employee logins, advanced inventory across many SKUs, or offline reliability – features often better served by a full POS system (like Clover or a robust iPad POS) rather than just a phone app.

There’s also the impression left on customers: a full POS station can seem more “established,” though these days customers are quite accustomed to phones or little white Square readers at markets. Ultimately, many farmers market vendors strike a balance: using a tablet-based POS (for a bigger screen and maybe a stand) but still keeping it simple and mobile (using cellular data, battery power, etc.).

One great aspect of starting simple is that you can often upgrade within the same ecosystem – e.g. start with free Square on your phone, later add a Square Stand for iPad or a Square Terminal as you scale up. Evaluate your budget, power availability, and feature requirements; then choose the setup that makes checkout smooth for you and your customers.

Conclusion

Choosing the right POS system for a farmers market booth is an important decision that can impact your sales and daily operations. The essential features we’ve outlined – from offline processing and fast checkout to inventory tracking, flexible receipts, EBT support, and beyond – are all about making your life easier as a vendor and creating a better experience for your customers. Especially in U.S. markets, considerations like accepting SNAP/EBT, handling sales tax, and offering modern payment methods are increasingly part of doing business and staying competitive.

When comparing options like Square, Clover, Shopify POS, or others, keep in mind the scale of your business and future growth. A small single-product farm stand may prioritize low cost and simplicity (a free app, minimal hardware), whereas a larger farm or cooperative might invest in a feature-rich system to handle complex inventory, multi-staff coordination, and higher volume. There is no one-size-fits-all answer – the best POS is the one that meets your needs reliably at a reasonable cost.

The good news is that technology has evolved to meet even the rustic charm of the farmers market. With a well-chosen POS system, you can maintain the personal, local feel of your stall while leveraging tools to boost efficiency and insights. You’ll spend less time fiddling with calculators or making change, and more time engaging with customers and growing your market business. In the end, the right POS lets you sell with confidence anywhere – rain or shine, online or offline – keeping your business fruitful season after season.

By considering the features and comparisons in this guide, you’ll be well on your way to picking a farmers market POS system that empowers you to focus on what you do best: providing great products and connecting with your community. Happy selling at the market!