By farmersmarketpos July 12, 2025

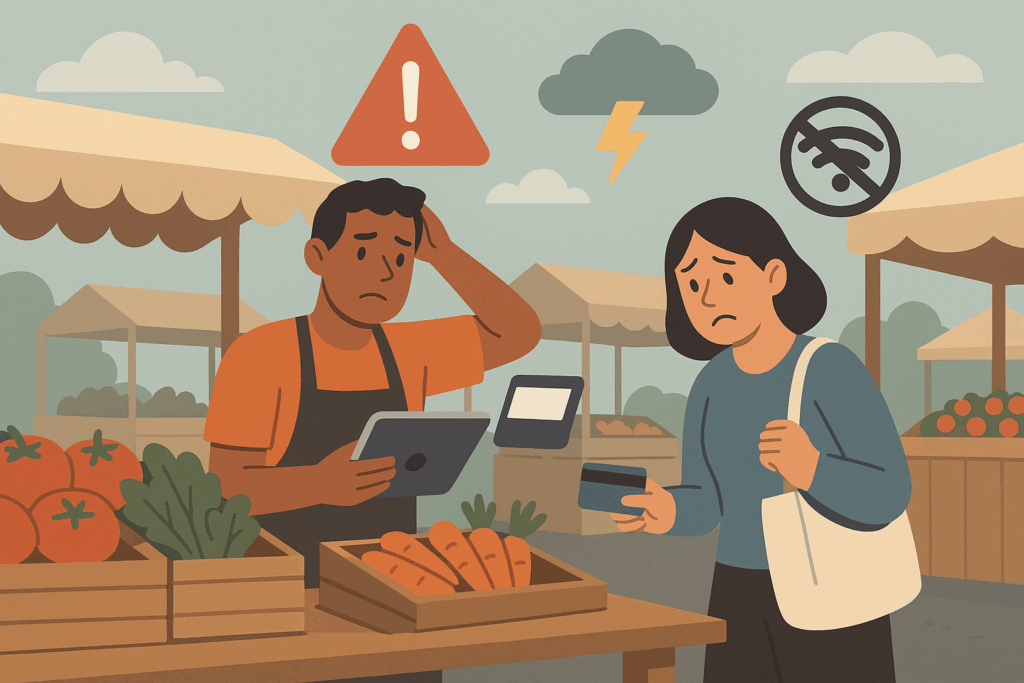

Mobile point-of-sale (POS) systems have revolutionized how vendors at U.S. farmers markets conduct business. In an environment where electrical outlets and Wi-Fi are often nonexistent, sellers face unique challenges in keeping their card readers and tablets running and processing payments. This guide explores the pain points of operating a mobile POS with limited power and connectivity, and provides practical solutions – from battery packs to offline payment modes – to ensure you never miss a sale.

We’ll also highlight popular mobile POS brands (like Square and Clover) and how they cater to farmers market needs. By following these tips and leveraging the latest features, even an open-air stall can offer a modern, seamless checkout experience for customers.

Challenges of Using POS Systems at Farmers Markets

Farmers markets are vibrant but technology-challenged settings. Understanding the pain points will help us address them effectively:

- Limited Power Sources: Many outdoor markets have no readily available electricity at vendor booths. You can’t just plug in a cash register or charger under a pop-up tent. If your devices run out of battery, you’re out of luck until you find power.

- Unreliable or No Internet: Internet connectivity at markets is often unreliable or completely absent. There’s usually no Wi-Fi, and cellular signals may be weak or congested due to crowds. Most POS systems normally require internet to process credit cards in real time – so no internet can mean no card sales.

- Weather and Environment: Being outdoors means dealing with weather that can affect devices (extreme heat/cold can drain batteries faster). Equipment also needs to be portable and rugged to handle moving between markets and possibly a bit of dust or moisture.

- Customer Expectations: Despite the rustic setting, today’s shoppers expect quick, cashless payment options. Over 81% of U.S. consumers now prefer using cards or digital payments, while cash transactions have dropped to about 12%. If your POS isn’t operational, you risk losing sales from customers who aren’t carrying enough cash.

Each of these challenges can be a real pain point for a farmer or artisan trying to sell goods. Fortunately, there are solutions. Next, we’ll tackle each problem one by one, exploring strategies to keep your mobile POS running even with no power or internet.

1. Lack of Power (Keeping Devices Charged All Day)

One of the biggest hurdles is powering your POS devices through a long market day. A typical farmers market might run 4-8 hours or more, and you often cannot plug into an outlet on-site. Relying solely on your device’s internal battery might leave you stranded before the day is done.

What could go wrong? Your tablet or card reader could die in the middle of a busy market rush, forcing you to stop taking card payments. This not only frustrates customers but can directly translate to lost revenue. Markets sometimes offer electric access for a fee, but it can be expensive or logistically difficult (and some markets disallow noisy gas generators).

Solution: Battery-Powered Devices with All-Day Life

The first strategy is to use hardware that’s built for mobility. Many modern POS systems offer dedicated mobile terminals with long battery life. For example, Square Terminal is a popular all-in-one device (with built-in card reader and receipt printer) designed for “cordless” use, and its battery is “designed to last all day”.

In fact, Square Terminal’s specs note roughly 24 hours of typical battery life on a full charge, which covers most market days. Likewise, Clover Flex, a handheld POS from Clover, lasts up to 8 hours on a single charge – plenty for a morning farmers market. These devices are purpose-built for pop-ups and markets, so they can run an entire event without needing a power outlet.

Keeping your mobile device’s battery healthy is key. Start every market with devices fully charged, and if possible, carry a spare phone or tablet as backup. Some POS hardware even comes with integrated chargers or battery cases. For instance, InVue’s NE360H (a mobile POS case) has a built-in charger to keep your iPhone powered throughout the day, preventing dead-battery issues. By choosing hardware optimized for battery longevity, you set yourself up for success.

Clover Flex mobile POS device offers a built-in receipt printer and roughly eight hours of battery life per charge. Portable all-in-one units like this are designed for farmers market vendors, ensuring you can handle transactions for an entire market day without plugging into power. Many modern POS devices emphasize extended battery performance so you never miss a sale due to a dead device.

Solution: Portable Battery Packs and Power Banks

Even with long-lasting devices, it’s smart to have portable power on hand. Battery packs (power banks) are an affordable insurance policy against dying batteries. These pocket-sized chargers can top up your phone, tablet, or POS terminal anywhere. For example, a 10,000 mAh USB power bank can usually recharge a typical smartphone 2-3 times. Smaller packs (5,000 mAh) might give one full charge to a phone or about 50% to a tablet, while larger packs (20,000+ mAh) can keep multiple devices running all day.

How to use battery packs effectively:

- Charge Them Up: Make sure all your power banks are fully charged before market day. It sounds obvious, but amid preparing produce or merchandise, it’s easy to forget to charge the charger! Create a checklist to charge your power bank along with your phone/POS the night before.

- Capacity and Ports: Choose a battery pack with sufficient capacity and the right ports for your devices. Many POS tablets/phones use USB-C or Lightning connectors now. Some power banks offer multiple USB outputs, which can charge a phone and a card reader simultaneously – useful if you have separate devices.

- Rugged and Reliable: Farmers markets can be dusty or occasionally get raindrops. Opt for a durable power bank (some are rubberized or water-resistant) that can handle outdoor conditions. Also consider a unit with a built-in charge indicator, so you know how much juice is left at any time.

With a charged 10,000+ mAh battery pack, you can confidently run a tablet-based POS and a Bluetooth card reader through a full market day. For instance, one farmers market vendor describes using a portable lithium “generator” (power station) to run not only their POS but also small lights for evening markets. While you may not need a large power station unless you’re powering appliances, the concept is the same – having your own power supply frees you from relying on venue electricity.

Solution: Quick-Swap or Backup Devices

Another power-continuity strategy is having a backup device ready. If you run your POS on a smartphone or tablet, consider bringing a second device (like an older phone or a spare tablet) charged and loaded with your POS app. In a pinch, you can swap the SIM card or connect the backup device to your card reader and continue selling with minimal interruption if your primary dies or malfunctions.

Some vendors also keep a basic phone charger and car adapter in case they can step away to recharge from a vehicle between crowds. If the farmers market has a slow period, a 10-15 minute top-up from your car’s outlet (or a friendly neighboring business with power) could give you enough battery to finish the day. This might not always be feasible, but it’s good to have the cables just in case.

Summary of Power Solutions: By using mobile-focused POS hardware with long battery life and supplementing with portable chargers, you can run a fully functional checkout counter with zero onsite power. The goal is to ensure your device stays on and functional from the first customer to the last, so you never have to utter “Sorry, I can’t take cards right now because my battery died.”

2. No Internet Connectivity (Processing Payments Offline)

The next big challenge is staying connected – or more specifically, being able to process transactions without connectivity. Most digital payments (credit/debit cards, mobile wallets) require contacting banks over the internet for authorization. At a market, you might be relying on cellular data, which can drop out. In remote rural markets or crowded urban ones, you may hit dead zones or overloaded networks, making it impossible for your POS app to reach the server.

What could go wrong? You swipe or insert a customer’s card and… nothing. The app stalls or shows an error due to no internet. Without a plan, you might have to ask the customer to pay cash or take an IOU, neither of which is ideal. Worse, you might not even know the internet is down until after trying a transaction, causing awkward delays.

Solution: Offline Mode for POS – Accept Payments Without Internet

Many top POS systems anticipated this problem and introduced an “Offline Mode”. Offline mode allows you to accept card payments even when you have no internet, by securely storing the transaction details and then processing them when you’re back online. In essence, the payment is deferred (completed later), but from the customer’s perspective it feels like a normal purchase – their card is swiped or dipped, and they get their product.

Systems like Square, Lightspeed, Revel, and Toast offer robust offline modes, each with features to keep business running during outages. For example, Square’s POS app will automatically detect when it’s offline (if you enabled offline mode in settings beforehand) and then allow card swipes in offline mode. Square’s offline payments are stored in the app and will automatically process when your device reconnects to the internet.

Clover’s mobile devices similarly have an offline transaction mode – as Clover puts it, enabling offline mode lets your device continue to accept payments even when your internet is weak or down.

There are some important considerations when using offline mode:

- Enable it Ahead of Time: You usually must turn on offline mode before losing connection. Go into your POS app settings while you still have internet and toggle on “Offline Payments” (in Square POS, for instance). This ensures the device will cache transactions. You also often can set a maximum transaction amount allowed offline to limit your risk (e.g. don’t accept a single $5,000 payment offline, as that’s risky if it declines later).

- Card Types and Methods: Not every payment method works offline. Typically, magstripe swipes are supported offline across the board. Many systems now also support EMV chip and contactless taps offline with newer hardware – for example, Square Terminal lets customers dip or tap cards offline and gives you up to 24 hours to upload the transactions. However, certain things like gift cards, QR code payments, or installment payments usually won’t work offline. Check your POS provider’s documentation on which card types are accepted in offline mode.

- Time Limits: Offline transactions aren’t meant to be held indefinitely. You must reconnect within a certain window for them to process. Square requires you to upload offline sales within 24 to 72 hours max, depending on device, and recommends uploading within 24 hours to minimize risk. If you fail to reconnect in time, those pending sales will expire and not be charged to the customer – essentially, you’d lose that money.

- You Assume the Risk: This is critical – when you take a card offline, there’s no real-time authorization. That means if the card is declined or fraudulent, you won’t know until later when you upload. The sale could bounce, and you won’t get paid for that transaction. As the merchant, you’re responsible for any declined or disputed offline payments. For this reason, it’s wise to use offline mode for smaller transactions or trusted repeat customers if possible, and to avoid it for very large sales or if something feels “off” about a card.

- Notify Customers (Optionally): It can help to politely mention to customers that your system is offline but you’re still recording the sale (especially if a delay might occur in emailing a receipt). For instance: “Our internet is acting up, but I can still swipe your card securely and it will process shortly.” Most people will understand, and this transparency can manage expectations. You don’t necessarily have to say anything, but some vendors like to, especially if you want to get contact info (see next point).

- Get Contact Info as Backup: Since you won’t know immediately if an offline payment is approved, it’s a good practice to collect a phone number or email from the customer during the sale. That way, if the payment fails later, you have a way to reach out and arrange an alternative payment. Square’s policy, for example, is that they cannot provide customer contact info for declined offline transactions – so it’s on you to get it upfront if you want the safety net.

When used wisely, offline mode is a lifesaver. You can continue swiping cards “as normal” and customers likely won’t even notice a difference. From their perspective, perhaps their digital receipt is emailed a bit later once you reconnect, but otherwise it’s seamless. As one expert noted, operating in offline mode can ensure you never have to turn away a ready-to-buy customer even if your Wi-Fi doesn’t work. It truly keeps your sales flowing instead of screeching to a halt due to connectivity issues.

Solution: Using Mobile Data and Hotspots

While offline mode is great as a safety net, ideally you want to have some connectivity if you can – both for immediate payment approvals and other app features (like inventory sync or email receipt sending on the spot). If the farmers market doesn’t provide Wi-Fi (most don’t), consider the following connectivity strategies:

- Device with Cellular Data: The simplest is to use your smartphone’s 4G/5G data. Many small vendors run the Square or Clover POS app on their phone, which has a cellular data connection. If you use a Wi-Fi only tablet, think about switching to a tablet with cellular capability, or use a phone as the POS device. Some dedicated POS terminals also offer cellular: for example, certain Clover devices can come with a 3G/4G SIM card option, and Toast (popular for food vendors) has a “Toast Go” handheld that uses LTE data. Having a device with its own data plan can liberate you from relying on external Wi-Fi.

- Mobile Hotspots: If you prefer using a Wi-Fi tablet or laptop for POS, you can use a mobile hotspot for internet. This could be the hotspot feature of your smartphone or a separate little hotspot device from your carrier. Keep in mind, using a phone as a hotspot will drain its battery faster – so pair this tip with those battery pack solutions! Also, test the hotspot at the market location beforehand if possible, to ensure your carrier has decent coverage there.

- Multi-Network or Backup SIM: If connectivity is absolutely mission-critical for you (say you sell high-dollar items and want authorizations in real time), one advanced tactic is carrying a backup SIM card or a second phone on a different carrier. For instance, maybe your primary phone is on Verizon, but you have an old phone on AT&T prepaid that you can activate if Verizon’s signal is out. This might be overkill for most produce sellers, but for some markets in borderline coverage areas, it could make a difference. There are also devices and routers that can auto-switch between cellular networks, but those are typically used in food trucks or retail setups more than a simple market booth.

- Plan for Data Use: Check that your data plan is sufficient – running a POS with dozens of transactions uses surprisingly little data (card transactions are just a few kilobytes each), but if you’re also emailing receipts or your catalog has images, it can add up. Generally, a few hundred MB for a day is more than enough in most cases. Ensure you won’t run into throttling (some plans reduce speed after a certain usage) especially if you also use the device to stream music or other tasks at your stall.

By proactively managing internet connectivity, you can minimize how often you even need offline mode. However, it’s always good to have offline mode as a backup. Think of having cellular/hotspot as your Plan A and offline mode as Plan B for internet outages. This layered approach means you’re prepared for both weak signals and total loss of signal.

Solution: Payment Deferral and Alternative Strategies

Sometimes, despite your best efforts with cell networks and offline mode, you might hit a scenario where technology just won’t cooperate (or perhaps you deliberately choose not to use offline mode for a risky large transaction). In these moments, consider these alternative payment strategies to still close the sale:

- Delayed Capture / Payment Links: If a customer is willing, you could take their order and email them an invoice or payment link later when you’re back online. For example, Square and PayPal allow you to send a digital invoice which the customer can pay by clicking a link. This is not as smooth as a normal checkout, but for a big sale it might be worth it. Make sure to get the customer’s email or phone number, and perhaps a signature on the invoice amount as proof. Clearly explain they won’t be charged on the spot, but will need to complete payment afterward. The risk is obvious – the customer might walk away and never pay – so this is usually something to use only if you trust the customer (or they’re a repeat who is happy to pay later).

- Manual Card Imprints / Old-School Method: Before the age of always-online payments, businesses used manual “knuckle buster” credit card imprinters to capture card info on a carbon slip to process later. Some veteran vendors still keep one of these as a last resort. If you have the customer’s card in hand, you could theoretically write down their card number, expiration, and have them sign a slip promising to pay. Later, you’d manually enter the card in your POS or virtual terminal when online. Important: This method has security and legality concerns – you must safeguard any written card data (PCI compliance) and you take on 100% fraud risk. It’s only mentioned as an emergency option if you and the customer are comfortable with it (for instance, a loyal customer who can’t pay any other way and you trust them). If you do this, never leave the paper lying around, and shred it after you’ve processed the payment.

- Accept Other Offline Payments: Remember that cash always works in an offline situation. It sounds basic, but it’s worth stating – as much as we love high-tech POS solutions, having a backup cash box for when all else fails is prudent. Some customers might also use personal payment apps like Venmo, Cash App, or Zelle which could be sent over cellular later if not immediately (though if your phone has no service, that’s equally an issue). If you both happen to use an app that can work offline (some peer-to-peer payments might queue until signal returns), that’s another avenue. Generally, though, stick to either cash or a formal deferred card payment if possible.

- Signage and Communication: If connectivity issues are frequent at your market, it may help to have a small sign prepared that says something like “Experiencing network issues – accepting cash or offline card payments (charges may post later). Thank you!” This sets expectations with customers. As noted in a Shopify POS guide, some retailers keep a sign “Cash Only During Internet Outages” ready to go. Just be sure to remove it or update it once things are back online. Good communication can turn a potentially frustrating situation into a minor inconvenience in your customers’ eyes.

By employing these payment deferral tactics, you ensure that even if you hit a worst-case scenario with no connectivity and limited offline tech, you can still find a way to complete sales rather than turning customers away. Every transaction saved is more revenue and goodwill for your business.

Popular Mobile POS Systems for Farmers Markets (and Their Offline Features)

When choosing a mobile POS for your farmers market stall, you’ll want to consider how well it handles the challenges we discussed. Here are a few popular POS solutions and how they fit into the offline/power-ready picture:

- Square POS: Square is hugely popular among small vendors for its simplicity and no monthly fees. Square offers a range of hardware, from the tiny Square Reader (plugs into your phone for swipe/chip/tap) to the all-in-one Square Terminal. Square’s app includes a robust offline mode – you can toggle it on and the app will encrypt and store card transactions when offline, then process them when connectivity returns. Square Terminal in particular is great for markets: it has all-day battery life and can print receipts, plus offline capability to take payments without internet.

Square was practically made for on-the-go selling, so it emphasizes battery (Terminal is cordless) and offline sales. Just remember the risk of offline transactions as mentioned. Also, if using just the phone + Square Reader, ensure your phone battery is up to snuff (or keep it charged with a power bank). - Clover: Clover is another popular brand (often available through banks or payment processors) with hardware like Clover Flex, Clover Go, and Clover Mini suited for mobile use. Clover Flex is a handheld device with a built-in card reader and printer; it runs about 8 hours per charge and supports offline mode to keep taking cards during outages. Clover Go is a smaller card reader that pairs with your phone – for that, you’d rely on your phone’s battery and connectivity, but the Clover app will queue transactions if you go offline. Clover’s system syncs everything to the cloud when back online so your reports stay accurate.

Clover devices are known for being user-friendly and having good battery optimization. The offline mode in Clover’s system means a farmer’s shaky market Wi-Fi won’t stop the checkout process – you can continue to accept payments and the device will upload them later. - Shopify POS: For sellers who also have an online store, Shopify POS is a common choice. It’s worth noting, however, that Shopify’s offline mode does NOT allow card processing offline – it only lets you record cash sales or custom payments offline. Essentially, with Shopify, you can keep using the app to log transactions, but you must have internet to actually charge credit cards. This is a key difference from Square or Clover. If your business already runs on Shopify it can be convenient for inventory sync, but if your market has no connectivity, Shopify POS might force you into cash-only mode during outages, which could be a dealbreaker.

Inventory and analytics integration, but not ideal for no-internet situations unless you’re comfortable taking cash until you reconnect. - Toast: Toast POS is a favorite among food vendors and food truck operators. It’s an Android-based system tailored for food service, but it also works for farmers market stands especially those selling prepared foods. Toast offers an offline mode as well – Toast’s Offline Mode allows you to continue taking payments (including credit cards) if their handheld devices lose connection, and then uploads when back online.

Toast’s Toast Go 2 device is a handheld that’s battery-powered and durable (splash-proof), good for outdoor conditions. The only catch is Toast is more of a full restaurant system, which might be overkill if you just need basic payments (and it has monthly fees). But for those selling hot food or running multiple kiosks, its offline and multi-device sync capabilities shine. - PayPal Zettle: Zettle (formerly iZettle, now owned by PayPal) offers a card reader and app with no monthly fee, similar to Square. However, Zettle has a notable limitation: it does not support offline transactions at all. If you lose internet, you simply cannot process card payments with Zettle until you reconnect. This makes it less ideal for farmers markets with spotty service, unless you’re certain you’ll have reliable cell data. On the plus side, the Zettle reader has a decent battery life and is relatively cheap, but you’d want a backup plan for connectivity (or a backup POS) if you go this route.

- Others: There are other mobile POS options like SumUp, Lightspeed (formerly ShopKeep), Vend, Revel, etc. SumUp does offer an offline mode as a backup (with similar conditions – you assume risk, must upload later). Lightspeed Retail’s app can operate offline for basic functions and will sync when back online (though like Shopify, card processing might not fully go through offline depending on configuration). When evaluating any system, look specifically at the offline capabilities and battery expectations. The best POS systems for farmers markets explicitly list offline mode and strong battery/portability features among their top selling points.

FAQs

Q: Can I run a card payment without any internet at all?

A: Yes, if your POS supports an offline mode. Systems like Square, Clover, Toast, and SumUp allow offline card transactions which are stored and then processed once you reconnect. Essentially, the payment is accepted (without approval at the moment) and queued.

Keep in mind there is a time limit (often 24-72 hours) to connect your device and finalize those payments, and you carry the risk if a payment is later declined. If your POS does not have such a mode (for example, Shopify POS cannot process cards offline, and PayPal Zettle has no offline mode), then you cannot charge a card without internet – you’d have to use cash or another offline method.

Q: What if my phone or tablet battery dies in the middle of the market?

A: The best approach is prevention: use devices with strong battery life and have backups. Start with a full charge on all devices. Carry a portable battery pack to recharge on the go – even a brief top-up can give you hours more use. If possible, bring a second device with your POS app installed (so you can swap SIM or Wi-Fi to it and continue). Many sellers keep a small car charger or a power bank in their kit so they’re prepared.

Also, some all-in-one POS terminals (like Square Terminal) have better battery life than phones and can last all day. But if, despite all, your device dies and you have no backup, you may have to resort to manual methods (taking cash or swiping cards later when you can power up). Don’t let it get to that point – plan your power needs and monitor battery levels throughout the day.

Q: Is it safe to use Offline Mode – what about fraud or failed payments?

A: Offline mode is generally safe in terms of data security – reputable POS apps encrypt the card details and store them securely until uploaded. The customer’s information isn’t visible to you or anyone else in the meantime, which is good. The big issue is financial risk: because there’s no instant authorization, a transaction could bounce (e.g., the card has insufficient funds or is stolen). If that happens, you will not get paid for that sale, and you typically have no recourse with your POS provider for reimbursement.

To mitigate this, set sensible limits (many systems let you cap offline transactions to, say, $50 or $100 each). You could also selectively use offline mode (for example, maybe use it for small purchases like a $5 basket of tomatoes, but if someone wants to spend $300 on farm meat and your signal is out, you might ask them to wait a minute for connectivity or pay by another method, rather than risk it).

In practice, declines on offline transactions aren’t extremely common, but they do happen, so use your best judgment. Also, collecting a customer’s contact info during the offline sale can help you follow up if needed – sometimes a polite call or email can resolve a failed payment after the fact (e.g., they provide a different card).

Q: What are some tips to improve cell signal at a farmers market?

A: First, try to identify the carrier with the best coverage in your market location – ask other vendors or the market manager. If your current phone carrier is weak there, consider getting a hotspot or SIM from another provider that has better coverage at that spot. Sometimes even moving your physical position slightly can help (if you’re in a low area, going to a higher spot, or simply ensuring your device isn’t buried behind metal containers).

There are cell signal booster accessories, but those typically require a power source and are used in vehicles or buildings – not very practical for a small stand. In general, newer phones have better antennas, so if you’re using an older smartphone for POS, upgrading could help connectivity. Lastly, avoid crowding your phone underneath tables or too close to other electronics that might interfere; keep it in a place where the antenna can “breathe.” If all else fails, use offline mode as a backup plan (as we’ve emphasized).

Q: How do I print receipts if I have no power for a printer?

A: Most farmers market vendors go paperless to avoid needing printers – they’ll email or text receipts via the POS app (which queues them if offline). However, if you do need to provide paper receipts (some customers or certain programs like SNAP/EBT transactions might require it), you have options. Many mobile POS devices have built-in printers (Square Terminal, Clover Flex, etc., include receipt printers powered by the device’s battery).

There are also portable Bluetooth receipt printers that run on batteries – you charge them beforehand and they can print all day. For example, a portable thermal printer can be battery-operated and connect wirelessly to your POS app. Ensure any such printer is fully charged before the market. They often can print hundreds of receipts on a charge.

If you don’t want to invest in hardware, you could also hand-write a receipt if absolutely necessary (old school, but acceptable for some customers). In many cases, though, an email receipt is easiest and preferred by customers – and it has the side benefit of capturing their contact for your mailing list.

Q: What if I sell out-of-coverage (rural area with zero signal)?

A: If you know in advance that your market has zero cell coverage for any carrier (a true off-the-grid location), plan accordingly. You will be relying on offline mode entirely for cards (assuming your POS supports it), or you might choose to operate as “cash/prepaid only” in that setting. For instance, some CSA farms will take payments online ahead of time and then just deliver goods at the market.

If you do go the offline route, have a strict process: maybe limit card sales to known customers or small amounts, and definitely get phone or email info so you can follow up. It’s also wise to increase your cash on hand in such scenarios, since some customers may be uncomfortable with offline card swipes (or you may simply decide not to risk large offline charges).

You could also explore if the market or community center has any landline that could be used with a traditional telephone-based credit card imprinter (some rural markets still use phone line terminals for EBT or credit). Those are rare, but it doesn’t hurt to ask the market manager. In summary, in completely no-signal areas, lean on cash and communicate clearly with patrons if card processing will be delayed or unavailable.

Conclusion

Operating a mobile POS at a farmers market without ready access to power or internet might seem daunting, but with the right tools and strategies it’s entirely feasible. By identifying the pain points – battery life and connectivity – and implementing the solutions we’ve discussed, you can create a robust setup that keeps your business running smoothly in any conditions.

To recap, power up for success by using long-lasting, portable POS devices or pairing your phone with high-capacity battery packs. Always charge everything beforehand and consider redundancies like backup devices or power banks. At the same time, prepare for patchy internet: use cellular data if possible, enable offline modes for your transactions, and know your system’s limits.

Popular solutions like Square and Clover have built-in answers to these challenges (offline functionality, durable hardware), and they’ve enabled thousands of market vendors to go beyond cash-only sales. As a result, even under a rustic tent, you can offer customers the convenience of paying by card or phone tap – which not only saves lost sales, but also enhances the professional image of your stall.

Finally, it’s about peace of mind. Instead of worrying whether the next low battery warning or dropped signal will shut you down, you’ll have the confidence that you can continue serving customers no matter what. The modern farmers market is a blend of tradition and technology: the smell of fresh produce and baked bread, paired with the beep of a card reader completing a sale. With this guide’s tips in hand, you’ll be well-equipped to handle the tech side of that equation – keeping your mobile POS running off-the-grid, so your business can thrive out in the field.